https://www.investmentjunctions.com/

Monday 27 February 2023

Thursday 23 February 2023

How to calculate SIP returns

How to Calculate SIP Returns?

There is no doubt that Systematic Investment Plans (SIP) has become one of the popular means to invest in mutual funds. After setting up an SIP, the investors invest a pre-determined amount of money at regular intervals in a specific mutual fund. You can invest in several mutual funds through SIP.

Many investors have the misconception that SIP investment is safer than onetime investment. It is just a myth and the returns on SIP investments depend on various factors such as the mutual fund category, the performance of the market and time.

In this article, we will discuss the different ways to calculate SIP returns.

Return Calculation for SIP

Calculation of SIP returns is little different from calculating returns on onetime investments. It is because SIPs are regular investments throughout the course of a period, while lump sum investment is a onetime investment.

One way that most investors calculate SIP returns to understand the growth in their SIP investments is by adding the total investment amount in the year and calculating the returns on the entire investment. However, it is not the right way to calculate the returns on SIP.

Let us take an instance for clarification. We assume that you have set up an SIP of Rs.10,000 that has given a return of 10%. In the case of SIP investments, the first SIP instalment will generate a return of Rs.1000 i.e., total 10% returns while the return on the next instalment will be Rs.916.67 and so on.

Ways to Calculate SIP returns

Here are some methods to calculate SIP returns:

Absolute Return

Absolute return is the easiest way to calculate mutual fund returns. It is also known as the point-to-point return, as the initial and present unit price (NAV) is used to calculate the returns.

Absolute return = (Present NAV – initial NAV) / initial NAV x 100

The absolute return can be used to calculate the annualised returns.

Let us assume that the NAV of a mutual fund has increased from 20 to 35 in 7 months or 210 days. In that case, the absolute return is 75%.

However, considering absolute returns to calculate SIP returns won’t be right, as the investor does not invest the total amount of SIP at one time.

Simple Annualised Return

The returns that are shown are typically yearly returns of an investment option. But what if your holding period is less than 12 months? In that case, you can annualise the returns.

Simple Annualised Return: ((1 + Absolute Rate of Return) ^ (365/number of days)) – 1

If we take the example where the absolute return was 75%, the annualised return will be

= {(1 + 75%) ^ (365/210)} – 1 = 164%

XIRR Method

XIRR is the most widely used method to calculate SIP returns as it considers the different cash flows to calculate the internal rate of return.

You can use the XIRR formula in excel to calculate the SIP returns.

XIRR formula in excel is: XIRR (value, dates, guess)

Conclusion

Calculation on SIP is little different from return calculations on one-time investment, as the SIPs are regular investments and the investment amount may vary. XIRR is the best way to calculate SIP returns. You can also use a SIP calculator to check out your SIP returns.

Wednesday 22 February 2023

What is shrinkflation ?

What is shrinkflation ....

Before

the discussion on this economic term, let's talk about two more economic terms,

one is Inflation & other is Deflation.

what is

Inflation in the Economy & how does it pinch our pocket

Inflation is the rate of increase in prices

over a given period of time, in a market economy, prices for goods and services

can always change. Some prices rise; some prices fall. Inflation occurs when

there is a broad increase in the prices of goods and services, not just of

individual items; it means, you can buy less for 100 today than you could

yesterday.

For

example: in the year 2010 one liter of milk cost Rs 20, now in the year 2023

one liter of milk costs Rs 50, so the cost increased within 13 years is Rs

30 it may pinch our pocket but we are bound to pay the price.

increased cost.

What is deflation

in the economy?

Deflation

is when consumer and asset prices decrease over time, and purchasing power

increases. Essentially, you can buy more goods or services tomorrow with the

same amount of money you have today. This is the mirror image of

inflation,

For

example: let's assume In the year 2010 most of the people used to buy

filament tube lights at Rs 100 ( 30 watts) per piece but now most of the people

buy LED tubes at RS 100 (30 watts), now the retailer can't sell filament tube at Rs 100 ( 30 watts) , he/she should clear his/her stock at a discounted

price, otherwise, that would be a bad inventory, this is deflation.

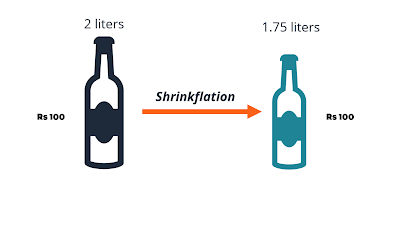

What

is shrinkflation:

The

situation when the price of a product stays the same but its size gets smaller: Shrinkflation is a cunning way of raising prices without

actually raising the price of the product you are buying. Many products have

been hit by shrinkflation.

Raja Bhattacharjee

Thursday 16 February 2023

Debt Mutual Funds vs Bank Fixed Deposits: A Better Option for Low-Risk Investors

Debt Mutual Funds vs Bank Fixed Deposits: A Better Option for Low-Risk Investors

For many investors, fixed deposits (FDs) offered by banks have been a traditional low-risk investment option. However, with the growth of the mutual fund industry, debt mutual funds have become a popular alternative for those seeking stable and reliable returns. In this article, we'll compare the two options to highlight why debt mutual funds may be a better choice for low-risk investors.

Fixed Deposits (FDs)

Fixed deposits are a type of investment in which an investor deposits a lump sum of money for a fixed term, typically ranging from one year to ten years. In return, the bank pays a fixed rate of interest for the term of the deposit.

One of the main benefits of fixed deposits is the stability they offer. The interest rate is guaranteed for the term of the deposit, providing investors with a predictable return. Additionally, FDs are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), providing insurance coverage of up to Rs. 5 lakhs per depositor per bank in the event of bank failure.

However, the stability of fixed deposits comes at a cost. The interest rate offered on FDs is typically lower than other investment options, and the returns are taxed as per the investor's income tax slab.

Debt Mutual Funds

Debt mutual funds invest in fixed-income securities such as government bonds, corporate bonds, and commercial paper. They are considered low-risk investments and offer a good option for those seeking stability in their portfolios.

One of the biggest advantages of debt mutual funds is the potential for higher returns compared to fixed deposits. The interest rate on debt securities fluctuates, which means that debt mutual funds can offer returns that are higher than the interest rate offered by fixed deposits.

Debt mutual funds also offer greater tax efficiency. Long-term Capital gains from debt mutual funds are taxed at 20% with indexation, which can significantly reduce the tax liability compared to fixed deposits, where the interest earned is taxed as per the investor's income tax slab.

Another advantage of debt mutual funds is their flexibility. Unlike fixed deposits, which have a fixed term, debt mutual funds can be redeemed at any time, providing investors with access to their money in an emergency.

While debt mutual funds do come with some degree of risk, the value of the securities in the fund can fluctuate due to fluctuations in the interest rate or changes in credit rating.

Final Thoughts

Debt mutual funds and fixed deposits both have their advantages and disadvantages, but for low-risk investors, debt mutual funds may be a better option. They offer the potential for higher returns and greater tax efficiency, along with the flexibility to redeem the investment at any time.

When deciding between the two options, consider your investment goals, risk tolerance, and financial situation. If you are seeking stability and a predictable return, a fixed deposit may be the right choice. However, if you are willing to accept a slightly higher level of risk for the potential of higher returns and greater tax efficiency, a debt mutual fund may be the better option.

Regardless of which option you choose, it is important to diversify your investments and not put all your eggs in one basket. This will help to minimize your risk and maximize your returns over the long term.

Raja Bhattacharjee

.jpeg)